PRESS RELEASE.

NTUC Income declares ambition to make insurance simple, honest and different for customers

NTUC Income declares ambition to make insurance simple, honest and different for customers

Insurer aims to set new industry standards and redefine how insurance is bought and sold

"Every person has a right to information that can be understood after a single reading, and every institution has the responsibility to communicate clearly. NTUC Income has achieved more Crystal Marks than any other business in Asia. This is a truly commendable effort from them to be clear and fair to their customers."

Chrissie Maher OBE, founder of Plain English Campaign

Singapore, 3 October 2012 – NTUC Income, Singapore’s leading insurer, announced that it is taking further steps in its commitment to honest insurance and putting the interests of its customers first.

In its latest move, NTUC Income has overhauled its contracts into plain English to make it easier for customers to understand its insurance policies and enable them to make informed decisions. This confronts the long-standing problem of customers not understanding insurance plans and sometimes buying a plan that is not right for them. This initiative stems from the insurer’s “Honest Insurance” philosophy and its continual endeavour to identify and solve pains and unfairness felt by customers.

NTUC Income is the first insurance company in Asia to undertake a major Crystal Mark initiative. Crystal Mark is a globally-recognised standard for plain English, used by many leading institutions in the UK, the US and Australia. It is a seal of approval guaranteeing a document is written in plain English and offers simple, clear and concise information. It is given by a British-based body, the Plain English Campaign, set up in 1979 to advocate the use of plain English in business.

The Plain English Campaign says that NTUC Income has the highest number of Crystal Marks of any business in Asia. NTUC Income has over 50 Crystal Marks and over 95% of NTUC Income’s customers will now have their contracts issued with Crystal Marks.

At the same time, NTUC Income is reinforcing its commitment to being upfront and transparent through a brand campaign that depicts how the use of jargon, overcomplicated phrases and terms and conditions can put a customer at a disadvantage. NTUC Income is committed to solving these pains and making insurance simple, honest and different. The campaign uses the * (asterisk) to symbolise insurer’s practices that cause customer pains.

This commitment is consistent with the Monetary Authority of Singapore’s Guidelines for Fair Dealing which seek to ensure that “customers receive clear, relevant and timely information to make informed financial decisions”.

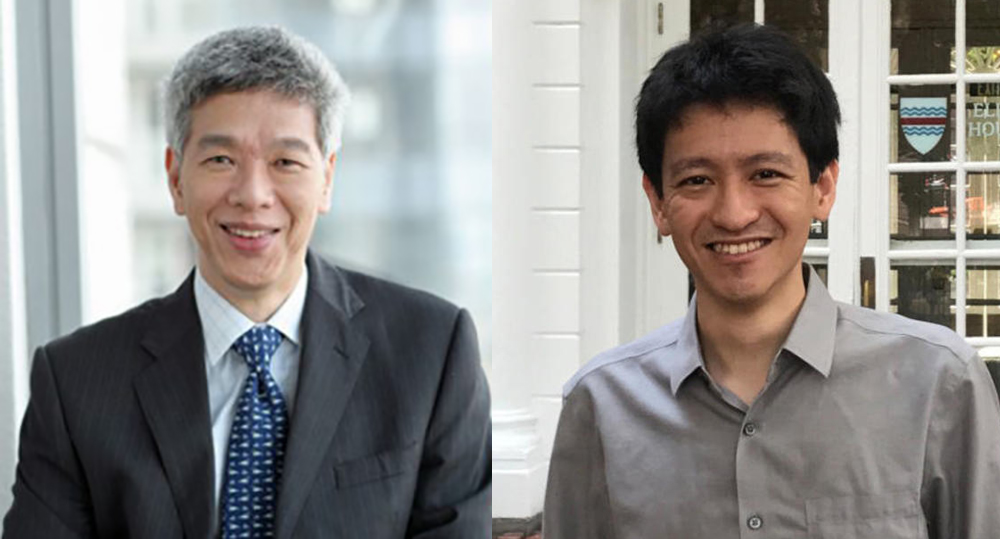

Mr Tan Suee Chieh, Chief Executive, NTUC Income said, “We are making our contracts as clear and as fair as possible, to demystify insurance and to give customers a fair deal. We will not hide behind legal technicalities and use them as excuses not to pay claims. Instead, we will always honour the intentions of our contract."

Mr Tan added, “NTUC Income will continue to take new and bold steps to set new insurance standards, eliminate customer pains and set a new agenda to make insurance simple, honest, different.”

Commenting on NTUC Income’s move, Mr Seah Seng Choon, Executive Director of the Consumers Association of Singapore, which champions consumer rights, said, “NTUC Income has taken the lead to revise its insurance contracts into simple English. Such a move can only benefit consumers, who are now more likely to read and understand what they are buying in. The launch of the plain English contracts, which is a massive undertaking that requires significant investment and effort, reflects NTUC Income’s customer-centricity.”

He added, “I am certain NTUC Income will benefit from customer loyalty in the long run. I urge more insurers and financial institutions to follow suit in making their contracts simpler and more reader-friendly. In so doing, they will demonstrate that they are taking care of their customers’ interests.”

Honest Insurance

Through applying its Honest Insurance philosophy, NTUC Income aims to change the insurance industry agenda and to take the lead in redefining how insurance policies are bought and sold.

In October 2011, NTUC Income launched Orange First, an initiative to drive the importance of fair dealing and trustworthiness into the foreground of its agents’ awareness.

In the area of transparency, NTUC Income has been the only insurer in Singapore to publish the yields of its life policies for the sixth year running.

In settling claims fairly, NTUC Income is committed to interpreting a contract according to its intention and not on the basis of legal technicalities.

Earlier this year, for example, NTUC Income made an exceptional payout under its Student Protection Plan (SPP) to the family of Lee Yu Heng, the Primary 4 student who died in a traffic accident outside his school in Sembawang. At the time of the accident, NTUC Income had not finalized the SPP contract with Yu Heng’s school. But there was evidence that NTUC Income was going to be selected and premiums would have been effective prior to the accident.

Legally, NTUC Income was not liable to pay because the contract had not been signed. However, it chose to honour the intent of the contract.

Back in 2010, the volcanic eruption in Iceland caused significant disruption to travels to and from Europe. Many travel insurance policyholders made claims for cancelled trips and flight delays. Going by the strict definition of policy terms and conditions, Iceland would have had to be the final planned destination for such claims to be admissible. But NTUC Income chose to honour the intent of the policy and processed more than 400 claims, and paid out an estimated $400,000.

Step change transformation through Orange Revolution

The Plain English project comes under the banner of Orange Speak, an initiative that is part of NTUC Income’s Orange Revolution. Mr Tan declared the Orange Revolution to over a thousand employees, agents and partners at a townhall meeting in October 2011. The objective of Orange Revolution is to set new insurance industry standards and redefine how insurance is bought and sold. It is supported by the pillars of Value and Honest Insurance and the underlying pursuit of Excellence.

Through the Orange Revolution, NTUC Income is doing things differently. The maiden initiative of this is the introduction of its Orange Force, NTUC Income’s fleet of motorcyclists who ride to the assistance of policyholders when they have a motor accident. The arrival of this elite force of 30 riders and their bright orange motorbikes on Singapore highways has helped reinforce NTUC Income’s status as the top motor insurer in Singapore, insuring one in four cars and one in two motorcycles. Orange Force is approaching its first anniversary. In its first year of operations, the force has made nearly 10,000 engagements and received over 300 written compliments from customers expressing their gratitude.

Said Mr Tan, “We are committed to doing things differently and to making insurance simple, honest and different. Throughout our transformation, NTUC Income will stay true to its social purpose of making insurance affordable, accessible and sustainable to all.”

About Plain English Campaign and Crystal Mark

Established in 1979, Plain English Campaign is a strong advocate of the use of plain English, encouraging organisations to communicate with the public clearly in plain language.

In 1990, Plain English Campaign introduced the Crystal Mark. The Crystal Mark is the organisation’s seal of approval for the clarity of a document. It has become firmly established as the standard that organisations aim for if they want to provide the clearest possible information to the public. The Crystal Mark now appears on more than 21,000 documents.

The Cabinet Office, GlaxoSmithKine, Abbeyfield UK and NatWest Bank are among organisations in the UK that have Crystal Marks.

About NTUC Income

NTUC Income was established in 1970 to provide affordable insurance for workers in Singapore. As a social enterprise, NTUC Income was made different from the start, with a mission to provide value for customers above maximising profits for shareholders.

NTUC Income is today a market leader in life, health, annuity and motor insurance and is committed to serving the needs of over two million customers. It has over $27 billion of assets under management.

NTUC Income’s corporate social responsibility focusses on equalising opportunities for children and youth from disadvantaged backgrounds.

Microsoft Word – 20121003 – Comparison – NTUC Income's Crystal Mark Contracts Vs Industry